Decent demo of the slippage or tracking error that occurs when holding leveraged ETFs over time. While these vehicles may be useful for trading, the tracking error erodes long term returns, making them undesirable for investors with long time horizons.

no positions

Saturday, December 31, 2011

Wednesday, December 28, 2011

More Gold Weakness

Action in precious metals continues ugly. New lows for the move today. Peering thru a longer time horizon lens, however, finds the yellow metal just now touching its multi-year uptrend line--a defined risk set-up for bullish traders.

One apparent takeaway from a macro perspective is that gold is not buying the thesis that the financial system is reliquifying--particularly w.r.t. the EU. Instead it is behaving like a wave of deleveraging, deflation in in the cards.

position in GLD

One apparent takeaway from a macro perspective is that gold is not buying the thesis that the financial system is reliquifying--particularly w.r.t. the EU. Instead it is behaving like a wave of deleveraging, deflation in in the cards.

position in GLD

Euro Rumblings

Am continuing to pick up chatter like this that the situation in Europe is worse than appears. The EU version of TARP, the Long Term Refinancing Operations (LTRO), has seen a commensurate jump in bank funds with the ECB Deposit Facility to a record high half trillion euros.

The implication is that interbank lending in Euro is largely frozen. Banks are instead choosing to keep funds w/ the central bank.

Deja vu pangs here, as this is very reminiscent of the risk averse behavior we saw stateside in 2008.

Which probably shouldn't be surprising. After all, the situations are largely the same. Risk seeking behavior and easy credit ran up massive debt and leverage. Now risk appetites are waning. And price declines threaten leverage systems with insolvency.

position in SPX

The implication is that interbank lending in Euro is largely frozen. Banks are instead choosing to keep funds w/ the central bank.

Deja vu pangs here, as this is very reminiscent of the risk averse behavior we saw stateside in 2008.

Which probably shouldn't be surprising. After all, the situations are largely the same. Risk seeking behavior and easy credit ran up massive debt and leverage. Now risk appetites are waning. And price declines threaten leverage systems with insolvency.

position in SPX

Thursday, December 22, 2011

Inverse Head and Shoulders Pattern

Back in early November technicians were eyeing the pennant patterns forming in the major indexes, and largely opining that the resolution of that pattern was likely to be higher. As we now know, the bulls were fooled as prices moved lower.

Now, technicians are eyeing a forming inverse head and shoulders pattern with similar optimism.

Will Hoofy's heros bring home the bacon this time? That seems to be the growing consensus.

Personally, I'm not playing it that way. There is far too much macro overhang for my tastes, not to mention overvaluation at the micro level, to merit holding a bunch of long equity risk.

Am currently about 10% net long, but that long exposure is in commodities. It is offset not quite one for one with an index equity short. This hedged position has not proven to be as effective this time around because of recent weak commodity performance relative to stocks.

Currently, however, my MO remains the same. Use price to my advantage to a) add exposure at lower prices and b) unload exposure at higher prices. All the while, I want to maintain sizeable dry power (read: cash and short term fixed income).

position in commodities, SPX

Now, technicians are eyeing a forming inverse head and shoulders pattern with similar optimism.

Will Hoofy's heros bring home the bacon this time? That seems to be the growing consensus.

Personally, I'm not playing it that way. There is far too much macro overhang for my tastes, not to mention overvaluation at the micro level, to merit holding a bunch of long equity risk.

Am currently about 10% net long, but that long exposure is in commodities. It is offset not quite one for one with an index equity short. This hedged position has not proven to be as effective this time around because of recent weak commodity performance relative to stocks.

Currently, however, my MO remains the same. Use price to my advantage to a) add exposure at lower prices and b) unload exposure at higher prices. All the while, I want to maintain sizeable dry power (read: cash and short term fixed income).

position in commodities, SPX

Wednesday, December 21, 2011

Hyper Hypothecation

On top of hypothecation and re-hypothecation, there is also hyper-hypothecation. Hyper-hypothecation is basically the re-hypothecation process done multiple times between various trading partners.

HH creates systemic counter-party risk in a leveraged system. If one trading partner in a chain fails to make good on a contract, then the entire system freezes up because there is not enough capital to meet all the margin calls.

Conceivably, prices may be in error if participants fail to understand the counterparty risks that cascade thru a market system. Once those risks are understood, prices are likely to drop...significantly.

This pretty much describes our ponzi-esque condition...

HH creates systemic counter-party risk in a leveraged system. If one trading partner in a chain fails to make good on a contract, then the entire system freezes up because there is not enough capital to meet all the margin calls.

Conceivably, prices may be in error if participants fail to understand the counterparty risks that cascade thru a market system. Once those risks are understood, prices are likely to drop...significantly.

This pretty much describes our ponzi-esque condition...

Monday, December 19, 2011

Hypothecation and Re-Hypothecation

The MF Global meltdown has brought the words 'hypothecation' and 're-hypothecation' to the forefront. Hypothecation is the relatively common situation where a buyer pledges collateral to secure a debt. The borrower retains ownership of the collateral, but in the 'hypothetical' case that the borrower defaults, then the creditor can take possession of the collateral.

In the US, the right of a creditor to take ownership of collateral if the debtor defaults is called a lien.

The lion's share of home mortgages reflect hypothecation. The home 'buyer' pledges the property to be purchased as collateral to secure a mortgage from a lender. Until the house is paid off, the creditor retains the right to take possession of the property if the borrower fails to keep up with mortgage payments.

Re-hypothecation occurs when financial entities pledge collateral that has already been posted by clients to support their own borrowing and trading. If a broker dealer such as MF Global puts up assets held by clients in 'margin accounts' as collateral to, say, speculate in Euro sovereign bonds, then this broker dealer would be engaging in re-hypothecation.

The immediate consequence of re-hypothecation is that it increases systemic leverage. More assets can be borrowed and controlled with less amounts of underlying equity.

As we noted many times on these pages, leverage becomes problematic when price moves against you. The higher the leverage, the smaller the change in price necessary to wipe you out.

Thus, when Euro bonds tanked over the past few months, MF Global was wiped out.

In the case where leverage is built on re-hypothecation, then the question becomes one of property rights. Whose property is lost when MF Global was wiped out? If re-hypothecation is in fact a legal aspect of a contract (e.g., a client of MF Global agrees that a condition of maintaining a 'margin account' at the firm is that holdings can be re-hypothecated for MF's own trading endeavors), then it is the client, not the firm, that is on the hook.

Thus, clients of MF Global may be out billions of dollars...

In the US, the right of a creditor to take ownership of collateral if the debtor defaults is called a lien.

The lion's share of home mortgages reflect hypothecation. The home 'buyer' pledges the property to be purchased as collateral to secure a mortgage from a lender. Until the house is paid off, the creditor retains the right to take possession of the property if the borrower fails to keep up with mortgage payments.

Re-hypothecation occurs when financial entities pledge collateral that has already been posted by clients to support their own borrowing and trading. If a broker dealer such as MF Global puts up assets held by clients in 'margin accounts' as collateral to, say, speculate in Euro sovereign bonds, then this broker dealer would be engaging in re-hypothecation.

The immediate consequence of re-hypothecation is that it increases systemic leverage. More assets can be borrowed and controlled with less amounts of underlying equity.

As we noted many times on these pages, leverage becomes problematic when price moves against you. The higher the leverage, the smaller the change in price necessary to wipe you out.

Thus, when Euro bonds tanked over the past few months, MF Global was wiped out.

In the case where leverage is built on re-hypothecation, then the question becomes one of property rights. Whose property is lost when MF Global was wiped out? If re-hypothecation is in fact a legal aspect of a contract (e.g., a client of MF Global agrees that a condition of maintaining a 'margin account' at the firm is that holdings can be re-hypothecated for MF's own trading endeavors), then it is the client, not the firm, that is on the hook.

Thus, clients of MF Global may be out billions of dollars...

Saturday, December 17, 2011

More Bass Thoughts

A couple of interviews w/ Kyle Bass that I have yet to chew fully thru. Similar themes to recent commentary. The end of ponzi in Japan, EU on fire, dysfunctional US govt. One new dimension was his bullish take on Canada--which is tempered by his bearishness elsewhere which will spill over in a negative way to the Knucks.

Interesting stat: value of bank assets worldwide: $87 trillion. Value of bank assets in Europe: $40 trillion. Euro bank balance sheets are 3x levered as the US.

When asked why ECB won't just print the debt whole, Bass said "Your question should be do they print before or after they default. In my opinion, they have to just print afterward because the number that they're going to have to print is so large that they all know this going in."

Not sure I understand exactly what he's saying here. Perhaps the transcript that I'm reading is out of context, and I'll know more once I watch the actual interview.

Interesting stat: value of bank assets worldwide: $87 trillion. Value of bank assets in Europe: $40 trillion. Euro bank balance sheets are 3x levered as the US.

When asked why ECB won't just print the debt whole, Bass said "Your question should be do they print before or after they default. In my opinion, they have to just print afterward because the number that they're going to have to print is so large that they all know this going in."

Not sure I understand exactly what he's saying here. Perhaps the transcript that I'm reading is out of context, and I'll know more once I watch the actual interview.

Wednesday, December 14, 2011

USD Trade Closed

Sold my small UUP call position this am into this morning's spike higher in the dollar.

Resistance is approaching dead ahead. Plus possible double top.

Just tradin' 'em...

no positions

Resistance is approaching dead ahead. Plus possible double top.

Just tradin' 'em...

no positions

The Problem with Fractional Reserve Systems

Nice overview of the Corzine/MF Global dynamic. As the author points out, the borrowing and levering of client assets is at the heart of this problem. And it is nothing new. Banks do it every day.

The leverage in a fractional reserve system means that the system is fragile. Fragile to small downward moves in price. Fragile to declines in confidence.

He's right. MF Global seems a chirping canary.

position in SPX

The leverage in a fractional reserve system means that the system is fragile. Fragile to small downward moves in price. Fragile to declines in confidence.

He's right. MF Global seems a chirping canary.

position in SPX

Lightly Buying

Buying some gold and silver this am into the continued smeltage. Support is coming up fast. Stochastics getting there as well. Stated differently, risk/reward is getting more attractive.

Nothing crazy, just some incremental adds. Truth be told, would welcome lower prices for more substantial buying.

position in GLD, SLV, CEF

Nothing crazy, just some incremental adds. Truth be told, would welcome lower prices for more substantial buying.

position in GLD, SLV, CEF

Monday, December 12, 2011

Hussman's Hard Negative

Another weekly letter by John Hussman that contains several nuggets of insight. Right off the bat, he makes it clear that conditions have turned decisively negative, in his view.

The current situation is "characterized by an extremely unfavorable ensemble of conditions across valuations, sentiment, economic factors, and other conditions. Current conditions cluster with periods such as May 1962, October 1973, July 2001, and December 2007, all of which produced 10-20% market losses in extremely short order."

Dr J notes the increasing disparity between the leading indicators that his firm and ECRI tracks, which now signal an extremely high probability of US recession, and the prognostications of mainstream forecasters and pundits.

He notes some exchange between a Bloomber interviewer and ECRI's, Lakshman Achuthan:

Bloomber interviewer: [ECRI recently made] a recession call. What happened?

Achuthan: It's happening.

Suggests significant cognitive dissonance out there regarding recession chances.

He also notes that the EU summit last week did (and can do) little to avert the central condition of credit crisis: solvency. Solvency is a shortfall between money owed and the resources needed to credibly repay it. Emphasis on 'credibly.' Printing money to pay back debts in devalued currency is not a credible strategy--at least in the eyes of creditors...

John suggests that perhaps one credible means for relieving stress in the EU is for countries to issue convertible sovereign bonds as they roll debt. The bonds would be convertible into the currency of the issuer at the option of the issuing government. Those countries with shaky fiscal houses would be required to pay a significant premium in order to compensate bond buyers for the commensurate risk.

Over time, John suggests, convertible debt might relieve the acute pressure that has built in the EU system. EU members would need to achieve sufficient financial credibility to remain in the EU system, lest they be subject to huge premiums on debt issued. The need for questionable bureaucratic enforcement mechanisms would be reduced. John suggests, "If the system can be saved, it will be saved" under such an arrangement.

One problem, of course, is that the significant discount that many EU countries currently enjoy by issuing debt under the implicit backing of the EU umbrella would vanish. Those countries would be forced to pay up and/or get their fiscal houses in order.

Market forces hate moral hazard...

position in SPX

The current situation is "characterized by an extremely unfavorable ensemble of conditions across valuations, sentiment, economic factors, and other conditions. Current conditions cluster with periods such as May 1962, October 1973, July 2001, and December 2007, all of which produced 10-20% market losses in extremely short order."

Dr J notes the increasing disparity between the leading indicators that his firm and ECRI tracks, which now signal an extremely high probability of US recession, and the prognostications of mainstream forecasters and pundits.

He notes some exchange between a Bloomber interviewer and ECRI's, Lakshman Achuthan:

Bloomber interviewer: [ECRI recently made] a recession call. What happened?

Achuthan: It's happening.

Suggests significant cognitive dissonance out there regarding recession chances.

He also notes that the EU summit last week did (and can do) little to avert the central condition of credit crisis: solvency. Solvency is a shortfall between money owed and the resources needed to credibly repay it. Emphasis on 'credibly.' Printing money to pay back debts in devalued currency is not a credible strategy--at least in the eyes of creditors...

John suggests that perhaps one credible means for relieving stress in the EU is for countries to issue convertible sovereign bonds as they roll debt. The bonds would be convertible into the currency of the issuer at the option of the issuing government. Those countries with shaky fiscal houses would be required to pay a significant premium in order to compensate bond buyers for the commensurate risk.

Over time, John suggests, convertible debt might relieve the acute pressure that has built in the EU system. EU members would need to achieve sufficient financial credibility to remain in the EU system, lest they be subject to huge premiums on debt issued. The need for questionable bureaucratic enforcement mechanisms would be reduced. John suggests, "If the system can be saved, it will be saved" under such an arrangement.

One problem, of course, is that the significant discount that many EU countries currently enjoy by issuing debt under the implicit backing of the EU umbrella would vanish. Those countries would be forced to pay up and/or get their fiscal houses in order.

Market forces hate moral hazard...

position in SPX

Gold Moving Lower

Never got off a comment last week on the head-and-shoulders (bearish) pattern setting up in gold. This morning gold is down nearly $50, which essentially validates the 'dandruff.'

Why the thrust downward in the yellow metal? Not sure, cookie, as there is no 'obvious' gold-related news on the tape. Over the weekend, however, there were some rumblings that last week's EU summit outcomes 'did not go far enough' in resolving the debt crisis. Swap spreads are generally widening today, with Greek spreads crossing the 10,000 bps mark--implying a 100% chance of default.

Am starting to sense that gold may be a leading indicator of another round of 'risk off' in the markets. Added to my short equity position this am, and may do more in the upcoming sessions depending on how things unfold.

position in GLD, SPX

Why the thrust downward in the yellow metal? Not sure, cookie, as there is no 'obvious' gold-related news on the tape. Over the weekend, however, there were some rumblings that last week's EU summit outcomes 'did not go far enough' in resolving the debt crisis. Swap spreads are generally widening today, with Greek spreads crossing the 10,000 bps mark--implying a 100% chance of default.

Am starting to sense that gold may be a leading indicator of another round of 'risk off' in the markets. Added to my short equity position this am, and may do more in the upcoming sessions depending on how things unfold.

position in GLD, SPX

Tuesday, December 6, 2011

Kyle Bass Macro Discussion

After a very interesting exchange last year, Kyle Bass returned for another insightful panel discussion this year (the actual discussion starts about 3 mins in).

I follow my fair share of macro discourse. I find the thoughts presented here as among the most interesting that I've heard. Bass' grasp of the sovereign debt and leverage situation is on a different level than most.

He is convinced that a EU crack up is imminent. From a silver lining standpoint, he suggests that, after observing the pending Euro collapse from front row seats, US policymakers might actually be stunned enough to proactively reverse course. Interesting thought.

On the other hand, he notes that capital flight into US Treasuries might lull policy makers into thinking that there is actually no crisis in our future.

In any event, this 1+ hr dialogue is worth your time. Personally, I plan to take it in a couple more times in the next few days.

position in USD, SPX

I follow my fair share of macro discourse. I find the thoughts presented here as among the most interesting that I've heard. Bass' grasp of the sovereign debt and leverage situation is on a different level than most.

He is convinced that a EU crack up is imminent. From a silver lining standpoint, he suggests that, after observing the pending Euro collapse from front row seats, US policymakers might actually be stunned enough to proactively reverse course. Interesting thought.

On the other hand, he notes that capital flight into US Treasuries might lull policy makers into thinking that there is actually no crisis in our future.

In any event, this 1+ hr dialogue is worth your time. Personally, I plan to take it in a couple more times in the next few days.

position in USD, SPX

Monday, December 5, 2011

Bail Out Mentality

Another sage letter by Dr J. In the front half he makes a compelling argument for a recession given the position of his forward looking indicators.

In the back half he discusses the EU situation given last week's 'coordinated' move by central banks. He reminds once again that the issue is one of solvency rather than of liquidity. Last week's coordinated dollar swap program is a short term measure aimed at boosting liquidity.

To remedy the solvency problem, it is likely that either banks fail or non-bank holders of EU debt must take haircuts. Thus far, no one wants to do that.

John ends with a section called "We represent the Lollipop Guild." His thoughts here are so wonderfully collected that I want to capture them here in their entirety:

"Frankly, I am concerned that Wall Street is becoming little more than a glorified crack house. Day after day, the sole focus of Wall Street is on more sugar, stronger sugar, Big Bazookas of sugar, unlimited sugar, and anything that will get somebody to deliver the sugar faster. This is like offering a lollipop to quiet down a 2-year old throwing a tantrum, and expecting that the result will be fewer tantrums.

"What we have increasingly observed over the past decade is nothing but the gradual destruction of the ability of the financial markets to allocate capital for the benefit of future growth. By preventing the natural discipline of the markets to impose losses on the poor stewards of capital, and to impose interest rates high enough to force debtors to allocate the capital usefully, the world's policy makers are increasingly wrecking the prospects for long-term economic growth. The world's standard of living (what we can consumer for the work we do) is intimately tied to its productivity (what we can produce for the work we do). That productivity requires scarce savings to be allocated to productive physical capital, and to productive human capital (primarily education).

"Nietzsche famously said, 'What does not kill me makes me stronger.' The corollary is 'What constantly rescues me makes me weaker.' The world will only stop looking for bailouts when policy makers stop handing them out."

Re-read until you understand.

In the back half he discusses the EU situation given last week's 'coordinated' move by central banks. He reminds once again that the issue is one of solvency rather than of liquidity. Last week's coordinated dollar swap program is a short term measure aimed at boosting liquidity.

To remedy the solvency problem, it is likely that either banks fail or non-bank holders of EU debt must take haircuts. Thus far, no one wants to do that.

John ends with a section called "We represent the Lollipop Guild." His thoughts here are so wonderfully collected that I want to capture them here in their entirety:

"Frankly, I am concerned that Wall Street is becoming little more than a glorified crack house. Day after day, the sole focus of Wall Street is on more sugar, stronger sugar, Big Bazookas of sugar, unlimited sugar, and anything that will get somebody to deliver the sugar faster. This is like offering a lollipop to quiet down a 2-year old throwing a tantrum, and expecting that the result will be fewer tantrums.

"What we have increasingly observed over the past decade is nothing but the gradual destruction of the ability of the financial markets to allocate capital for the benefit of future growth. By preventing the natural discipline of the markets to impose losses on the poor stewards of capital, and to impose interest rates high enough to force debtors to allocate the capital usefully, the world's policy makers are increasingly wrecking the prospects for long-term economic growth. The world's standard of living (what we can consumer for the work we do) is intimately tied to its productivity (what we can produce for the work we do). That productivity requires scarce savings to be allocated to productive physical capital, and to productive human capital (primarily education).

"Nietzsche famously said, 'What does not kill me makes me stronger.' The corollary is 'What constantly rescues me makes me weaker.' The world will only stop looking for bailouts when policy makers stop handing them out."

Re-read until you understand.

Labels:

debt,

EU,

Fed,

leverage,

macro issues,

moral hazard

Wednesday, November 30, 2011

The Infuence of Today's Events on Inflation

As noted in this morning's post, central banks got out the bazookas today in an attempt to blow away systemic deflationary forces that are driving Euro and US banks toward insolvency.

On the surface, the concerted central bank actions are clearly inflationary.

This post on zerohedge w/ Peter Schiff comments captures it well. The snippet at the end of the post REALLY captures it well:

"...this is merely the beginning as more and more inflationary actions have to be undertaken by central banks to save banks from being crushed by untenable debt loads. Whether they succeed in overturning the deflationary tsunami is unknown. What is certain is that they will bring fiat currencies to the [brink] of viability (and beyond) in trying."

As the snippet notes, the big question is whether this collective action will work. In late 2008, the Fed got out the fire hose of liquidity to stem the Lehman blowup. After a sharp relief rally on the news, however, markets resumed their downward path as the deflationary forces were not to be denied.

Hard not to wonder whether the same set up might not be in play here. Yes, the collective bazooka exceeds the power of the Fed's firehose. But the deflationary forces are more global in nature this time around.

Peter Schiff suggests that this is the time to load up on gold. That may turn out to be the case. Heck, gold popped 40 handles today.

But the other side of the trade is that the market forces pressing against the intervention are deflationary in nature.

And it's generally not nice to fool Mother Nature.

position in SPX, gold

On the surface, the concerted central bank actions are clearly inflationary.

This post on zerohedge w/ Peter Schiff comments captures it well. The snippet at the end of the post REALLY captures it well:

"...this is merely the beginning as more and more inflationary actions have to be undertaken by central banks to save banks from being crushed by untenable debt loads. Whether they succeed in overturning the deflationary tsunami is unknown. What is certain is that they will bring fiat currencies to the [brink] of viability (and beyond) in trying."

As the snippet notes, the big question is whether this collective action will work. In late 2008, the Fed got out the fire hose of liquidity to stem the Lehman blowup. After a sharp relief rally on the news, however, markets resumed their downward path as the deflationary forces were not to be denied.

Hard not to wonder whether the same set up might not be in play here. Yes, the collective bazooka exceeds the power of the Fed's firehose. But the deflationary forces are more global in nature this time around.

Peter Schiff suggests that this is the time to load up on gold. That may turn out to be the case. Heck, gold popped 40 handles today.

But the other side of the trade is that the market forces pressing against the intervention are deflationary in nature.

And it's generally not nice to fool Mother Nature.

position in SPX, gold

Central Banks Announce Coordinated Measures

This morning central banks around the world announced coordinated measures to enhance global financial system liquidity. Coordinated measures like this imply that central bankers see something severely wrong with the global financial system.

Their perceptions of systemic probs are correct, although as usual they are behind the curve.

Unfortunately, the planned approach--i.e., 'more liquidity'--does little to remedy the underlying problem, which is one of insolvency.

Nonetheless, the news jacked markets around the world. Domestic stock markets have opened about 2% higher. Gold jumped $30 on the money printing spectre.

My inclination is to 'fade' (read: sell) this news and will be looking for an opportunity to add to short side exposure.

position in SPX, gold

Their perceptions of systemic probs are correct, although as usual they are behind the curve.

Unfortunately, the planned approach--i.e., 'more liquidity'--does little to remedy the underlying problem, which is one of insolvency.

Nonetheless, the news jacked markets around the world. Domestic stock markets have opened about 2% higher. Gold jumped $30 on the money printing spectre.

My inclination is to 'fade' (read: sell) this news and will be looking for an opportunity to add to short side exposure.

position in SPX, gold

Monday, November 28, 2011

Durable Rally, or Short Term Relief?

If we were to assign news-related causes to today' 2-3% stock market rally, it would probably be a blend of better than expected Black Friday sales plus the spectre of (another) Euro bailout. Of course, we learned today that a) the IMF had no Italian bailout program in motion, and b) last week's retail sales numbers may be greatly exaggerated.

So perhaps today's move is just one more rally to blow off some near term selling pressure.

Technically, an upside move 'works' to SPX 1220.

Other technical evidence, however, is not in synch with a sustained upside move. After an early move lower, Treasuries recovered most of the day's losses. Bank stocks gave up a big chunk of their early gains. The dollar also closed near even after early selling. Oil closed near its lows.

Hard not to view these 'divergences' with some skepticism about the prospects for big upside from here. Time will tell, of course.

Personally, I did a whole lot of nuttin' today. Will likely put back on some of the incremental short exposure ditched last week should prices continue higher toward 1220. Other than that, I continue to be active in the physical metals market, buying both gold and silver.

position in SPX, gold, silver

So perhaps today's move is just one more rally to blow off some near term selling pressure.

Technically, an upside move 'works' to SPX 1220.

Other technical evidence, however, is not in synch with a sustained upside move. After an early move lower, Treasuries recovered most of the day's losses. Bank stocks gave up a big chunk of their early gains. The dollar also closed near even after early selling. Oil closed near its lows.

Hard not to view these 'divergences' with some skepticism about the prospects for big upside from here. Time will tell, of course.

Personally, I did a whole lot of nuttin' today. Will likely put back on some of the incremental short exposure ditched last week should prices continue higher toward 1220. Other than that, I continue to be active in the physical metals market, buying both gold and silver.

position in SPX, gold, silver

Cash Rich, Balance Sheet Poor

Interesting weekly comment by John Hussman, particularly the back half devoted to corporate balance sheets. Many bulls claim that corporations are 'flush with cash' and that corporate balance sheets 'have never been stronger.' As Dr J demonstrates, these claims have little merit.

When compared to the amount of debt on corporate balance sheets, cash has been coming off historical lows. Cash as a fraction of net worth and total assets is also small (in the 5-10% range).

As such, much of the 'cash' on corporate balance sheets comes from debt. Corporations have been building cash in this manner due to cheap financing terms.

Make no mistake, the dominant feature of today's corporation continues to be debt and leverage, not cash.

John also comments on another eye-opening trend: the decline in tangible assets in non-finance corporations. The fraction of tangible assets to total assets is now below half. The remaining assets are financial assets such as debt securities and stocks.

As John notes, "This is striking, in that we presently have a menu of prospective returns on financial assets that is among the most dismal in history."

This is another argument for tangible assets (e.g., commodities) over financial assets, and for companies that are weighted toward more tangible assets.

position in commodities

When compared to the amount of debt on corporate balance sheets, cash has been coming off historical lows. Cash as a fraction of net worth and total assets is also small (in the 5-10% range).

As such, much of the 'cash' on corporate balance sheets comes from debt. Corporations have been building cash in this manner due to cheap financing terms.

Make no mistake, the dominant feature of today's corporation continues to be debt and leverage, not cash.

John also comments on another eye-opening trend: the decline in tangible assets in non-finance corporations. The fraction of tangible assets to total assets is now below half. The remaining assets are financial assets such as debt securities and stocks.

As John notes, "This is striking, in that we presently have a menu of prospective returns on financial assets that is among the most dismal in history."

This is another argument for tangible assets (e.g., commodities) over financial assets, and for companies that are weighted toward more tangible assets.

position in commodities

Wednesday, November 23, 2011

Reducing Short Exposure

Tossed about 20% of my SPX short to the trading gods in respect of the move lower that we've seen. Technically, we're approaching what might be thought of as a 'minor' support level at 1160ish.

More substantial support rests at about 1120ish.

Will look to piece out more short exposure on extended weakness. Will also look to add to my metals exposure should they continue weak as well.

position in SPX

More substantial support rests at about 1120ish.

Will look to piece out more short exposure on extended weakness. Will also look to add to my metals exposure should they continue weak as well.

position in SPX

Bid Wanted Bunds

Germany experienced a 'bids wanted' situation in their bond auction last nite. The country could not get off more than 1/3 of its 10 yr notes.

Now that the best house in a bad neighborhood is having trouble getting credit, hard not to wonder how distant a Euro might implosion be...

Now that the best house in a bad neighborhood is having trouble getting credit, hard not to wonder how distant a Euro might implosion be...

Monday, November 21, 2011

Flag Pattern Resolved

Last week's question about which way the pennant pattern in major market indexes would break has been answered. The pattern has resolved to the downside.

The reason being assigned to the rhyme this morning is the budget supercommittee's (gotta like that term) failure to come to an agreement over $1.2 trillion in spending cuts. No deal inked by Wed means across-the-board cuts of like amount commencing in 2013.

This sets up the 2012 elections as a referendum on Big Govt.

Of course, other issues are weighing markets as well. Europe is still on fire, and fallout from the meltdown of MF global is wreaking havoc in commodity markets.

Personally, am leaning slightly net long--about 5-7% of liquid assets. In other words, the value of long positions (primarily commodities) outweights the value of short positions (SPX index short) by a small amount.

Should stock slippage continue another 30 SPX handles or so, I'll start looking to cover some of my short position (support resides in SPX 1120-1140 range). With precious metals getting slapped around today (gold and silver both off 3-4%), am itching to add to those positions as well.

positions in SPX, gold, silver

The reason being assigned to the rhyme this morning is the budget supercommittee's (gotta like that term) failure to come to an agreement over $1.2 trillion in spending cuts. No deal inked by Wed means across-the-board cuts of like amount commencing in 2013.

This sets up the 2012 elections as a referendum on Big Govt.

Of course, other issues are weighing markets as well. Europe is still on fire, and fallout from the meltdown of MF global is wreaking havoc in commodity markets.

Personally, am leaning slightly net long--about 5-7% of liquid assets. In other words, the value of long positions (primarily commodities) outweights the value of short positions (SPX index short) by a small amount.

Should stock slippage continue another 30 SPX handles or so, I'll start looking to cover some of my short position (support resides in SPX 1120-1140 range). With precious metals getting slapped around today (gold and silver both off 3-4%), am itching to add to those positions as well.

positions in SPX, gold, silver

Sunday, November 20, 2011

Widening LIBOR Spreads

Credit default swap (CDS) spreads have been widening in the LIBOR market. The gray line below constitutes CDS spreads of banks participating in the interbank lending markets.

Levels now exceed Lehman 2008 levels.

The gist: acute concern about the solvency of LIBOR centric banks.

Levels now exceed Lehman 2008 levels.

The gist: acute concern about the solvency of LIBOR centric banks.

Tuesday, November 15, 2011

Flag Pattern in SPX

The eyes of many traders are glued to the 'flag' or pennant' pattern forming in the SPX. Among the traders that I follow, it seems that most anticipate an upside resolution to the pattern.

Classic technical analysis says that chance favors resolution the direction of the previously prevailing trend. Yes, we've rallied off the early October lows, suggesting that the prevailing trend is up.

A counter view is that we've been experiencing only a bear market rally since October. A broader time horizon suggests a series of 'lower highs' since spring--in which case the primary trend could be interpreted as down.

In any event, we should get an answer pretty soon...

position in SPX

Classic technical analysis says that chance favors resolution the direction of the previously prevailing trend. Yes, we've rallied off the early October lows, suggesting that the prevailing trend is up.

A counter view is that we've been experiencing only a bear market rally since October. A broader time horizon suggests a series of 'lower highs' since spring--in which case the primary trend could be interpreted as down.

In any event, we should get an answer pretty soon...

position in SPX

Wednesday, November 9, 2011

More Italian Turmoil

Turmoil is increasing in Italy. Yesterday a major London clearing house raise margin requirements on Italian sovereign debt, sparking a wave of bond selling. Longer dated Italian sovereign debt is marking new lows this am. Commensurately, Italian swap spreads are blowing out.

Italy PM Berlusconi is rumored to be stepping down soon. My buddy Fil shares some thoughts on the consequences.

Markets around the world are listening to some chin music as a result. Stateside markets have opened down a coupla percent.

position in SPX

Italy PM Berlusconi is rumored to be stepping down soon. My buddy Fil shares some thoughts on the consequences.

Markets around the world are listening to some chin music as a result. Stateside markets have opened down a coupla percent.

position in SPX

Tuesday, November 8, 2011

Bullish Silver Pattern

Silver appears to be tracing out a cup and handle-ish pattern. Added to my SLV position this am and may add a bit more around here.

Should SLV start to 'fill the gap' precipitated by the mid Sept meltdown, then a trade 'works' to 38ish.

position in SLV

Should SLV start to 'fill the gap' precipitated by the mid Sept meltdown, then a trade 'works' to 38ish.

position in SLV

Monday, November 7, 2011

Pressure Rising in Italy

Italy continues to look like the next EU hotspot. Italian sovereign debt is marking new lows this am. Chatter is getting louder that the Italian prime minister Berlusconi and his administration are on the way out.

Contacts from my network that know the situation suggest that income administrations are likely to make Berlusconi look like the austerity king...

Contacts from my network that know the situation suggest that income administrations are likely to make Berlusconi look like the austerity king...

Thursday, November 3, 2011

Last Week's Euro Plan Explained

Wondering about the plan hatched last wk in the euro zone? This explains it pretty well.

Another 'debt w/ more debt' proposal...

Another 'debt w/ more debt' proposal...

Tuesday, November 1, 2011

Greece Balks on Deal

In a move said to have 'blindsided' many, the Greek government has called for a referendum (a.k.a. a vote of confidence) on the bailout plan recently hatched by EU officials.

The word is that the 'voluntary' 50% writedowns on Greek debt may have been palatable to many external holders of Greek debt, but those inside Greece holding their own country's bonds, including Greek banks, don't want to take the haircut. For one, it would render some Greek banks insolvent.

The theme from Wall Street types in my personal circle is that, while they were largely skeptical that the plan put together last week would hold up, they are surprised by how fast it is unraveling.

That surprise is being reflected in markets worldwide. Sovereign debt of many Euro countries like Greece and Italy is getting crushed today. Stock markets are listening to chin music as well. The SPX is down about 2.5% in early trading.

Seems to me that domestic stock markets are in a precarious situation currently. Shorts have been squeezed out, hedgies have been buyin' 'em after feeling 'underinvested, and there has been a general movement toward more 'risk on' out of euphoria that the EU didn't collapse in early Oct.

Perhaps the collapse was merely postponed by a month or so.

From where I sit, if the SPX can't hold 1220 support, then it looks pretty vulnerable for a downside whoosh.

position in SPX

The word is that the 'voluntary' 50% writedowns on Greek debt may have been palatable to many external holders of Greek debt, but those inside Greece holding their own country's bonds, including Greek banks, don't want to take the haircut. For one, it would render some Greek banks insolvent.

The theme from Wall Street types in my personal circle is that, while they were largely skeptical that the plan put together last week would hold up, they are surprised by how fast it is unraveling.

That surprise is being reflected in markets worldwide. Sovereign debt of many Euro countries like Greece and Italy is getting crushed today. Stock markets are listening to chin music as well. The SPX is down about 2.5% in early trading.

Seems to me that domestic stock markets are in a precarious situation currently. Shorts have been squeezed out, hedgies have been buyin' 'em after feeling 'underinvested, and there has been a general movement toward more 'risk on' out of euphoria that the EU didn't collapse in early Oct.

Perhaps the collapse was merely postponed by a month or so.

From where I sit, if the SPX can't hold 1220 support, then it looks pretty vulnerable for a downside whoosh.

position in SPX

Monday, October 31, 2011

EU Plan Soft on Details

Nice piece by John Mauldin on the sketchy nature of last week's EU summit plan w.r.t. Greece. Long on hope, short on substance.

Two particularly salient points:

Guaranteeing 20% of a government bond is pointless. When sovereign debt goes south, it is usually for a whole lot more than 20%. Greece is starting at 50%.

Changing the CDS rules. Part of last week's accord was that Greek bondholders would agree to a 50% writedown. Because this was agreed to by the creditors, the contention is that this was not a formal default, thus it would not flip the 'credit event' switch on credit default swaps.

Those big banks who were short gobs of Greek sovereign CDS's thus got a big bailout.

Those long Greek sovereign CDSs basically learned that the rules governing CDS's could be changed midstream. If these folks were seeking to hedge Greek debt exposure or bet on a Greek default they have to a) find another vehicle, or b) no participate in this market.

As such, should it be at all surprising that we saw sovereign debt of other EU countries weaken over the past few days?

position in SPX

Two particularly salient points:

Guaranteeing 20% of a government bond is pointless. When sovereign debt goes south, it is usually for a whole lot more than 20%. Greece is starting at 50%.

Changing the CDS rules. Part of last week's accord was that Greek bondholders would agree to a 50% writedown. Because this was agreed to by the creditors, the contention is that this was not a formal default, thus it would not flip the 'credit event' switch on credit default swaps.

Those big banks who were short gobs of Greek sovereign CDS's thus got a big bailout.

Those long Greek sovereign CDSs basically learned that the rules governing CDS's could be changed midstream. If these folks were seeking to hedge Greek debt exposure or bet on a Greek default they have to a) find another vehicle, or b) no participate in this market.

As such, should it be at all surprising that we saw sovereign debt of other EU countries weaken over the past few days?

position in SPX

Sunday, October 30, 2011

Ags Look Interesting

Have been adding to my agricultural commodity position (RJA) over the past few days. From a technical standpoint, looks like a multi-month reverse head-and-shoulders to me w/ a gap directly above (gaps tend to be magnets for price).

From a fundamental/macro standpoint, we've waxed about the bullish set-up in commodities before (dollar heading to dust, capacity not keeping up w/ demand, gov't policies that favor famine).

As such, I'm digging this for the long side of my hedge book.

position in RJA

From a fundamental/macro standpoint, we've waxed about the bullish set-up in commodities before (dollar heading to dust, capacity not keeping up w/ demand, gov't policies that favor famine).

As such, I'm digging this for the long side of my hedge book.

position in RJA

Friday, October 28, 2011

Did Germany Capitulate?

Many view yesterday's EU agreement as a capitulation by Germany. Essentially, risk was re-syndicated from the balance sheets of banks lugging euro sovereign debt onto the backs of German taxpayers.

Germany has essentially signalled the loss of its individual sovereignty in for of the EU collective.

Peter Atwater cautions against this conclusion. Yesterday's events bring into ever greater focus Germany's continued willingness and capacity to support the rest of Europe.

Many view yesterday's events as Germany's willingness to write giant blank checks to the rest of the EU. Atwater disagrees, and suggests instead that Germany will likely make future funds contingent on specific and prehaps tortuous preconditions.

If Peter is correct, then markets are nowhere close to figuring this out.

position in SPX

Germany has essentially signalled the loss of its individual sovereignty in for of the EU collective.

Peter Atwater cautions against this conclusion. Yesterday's events bring into ever greater focus Germany's continued willingness and capacity to support the rest of Europe.

Many view yesterday's events as Germany's willingness to write giant blank checks to the rest of the EU. Atwater disagrees, and suggests instead that Germany will likely make future funds contingent on specific and prehaps tortuous preconditions.

If Peter is correct, then markets are nowhere close to figuring this out.

position in SPX

Thursday, October 27, 2011

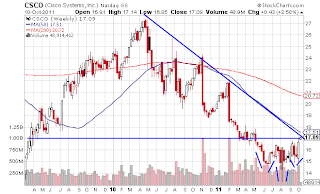

Making Sales

Sold most of my Cisco (CSCO) position. Did some yesterday and then lion's share this am into the EU bailout euphoria. Will keep a small 'core' position bought at much lower levels. I do think that the stock reflects decent value here but I also think chances of buying it much cheaper in the next few months are good given the macro set-up.

After the sale, my overall risk position is pretty much hedged. My remaining position in CSCO coupled with some commodity exposure (GLD, SLV, RJA) is offset nearly one for one by an index equity short (SH).

If prices continue to rip higher from here, then I might sell of bit of commodity exposure or add a bit to my index short. If prices reverse lower from here, then I might add some more precious metal exposure or shed some of my short position.

Meanwhile I wanna sit back and observe for a while.

position in CSCO, GLD, SLV, RJA, SH

After the sale, my overall risk position is pretty much hedged. My remaining position in CSCO coupled with some commodity exposure (GLD, SLV, RJA) is offset nearly one for one by an index equity short (SH).

If prices continue to rip higher from here, then I might sell of bit of commodity exposure or add a bit to my index short. If prices reverse lower from here, then I might add some more precious metal exposure or shed some of my short position.

Meanwhile I wanna sit back and observe for a while.

position in CSCO, GLD, SLV, RJA, SH

Monday, October 24, 2011

More Resistance Overhead

Markets continue to gear higher. The SPX is now up 17% from the early Oct lows. Can it continue? Sure, markets can do anything they want, cookie.

The technicals suggest some stiff resistance dead ahead in the 1260ish area. Many of the stochastic oscillators are starting to 'pretzel' in overbought zones on a daily basis.

I for one have resumed hedging mode, adding some index shorts (SH) against my equity (CSCO) longs. I have trimmed a bit of CSCO but hope to do much more into any further strength.

Have also been adding some GLD and ultimately would like that to represent the lion's share of my long side exposure here.

Right now I'm 7-8% net long. I hope to be 'delta neutral' in the near future. Long some CSCO and GLD paired against an index short.

position in CSCO, GLD, SH

The technicals suggest some stiff resistance dead ahead in the 1260ish area. Many of the stochastic oscillators are starting to 'pretzel' in overbought zones on a daily basis.

I for one have resumed hedging mode, adding some index shorts (SH) against my equity (CSCO) longs. I have trimmed a bit of CSCO but hope to do much more into any further strength.

Have also been adding some GLD and ultimately would like that to represent the lion's share of my long side exposure here.

Right now I'm 7-8% net long. I hope to be 'delta neutral' in the near future. Long some CSCO and GLD paired against an index short.

position in CSCO, GLD, SH

Tuesday, October 18, 2011

SPX Tests Resistance Level Again

Once again, it was close but no cigar as the SPX once again challenged the 1225 level but could not decisively break through.

Today's challenge was largely mounted on the back of a late day surge on news that the EU was getting set to ban naked CDSs.

Since last weekend, I've been visualizing a 'pop-and-drop' scenario that would mirror the 'drop-and-pop' event from a couple of weeks ago. A sort of poetic symmetry that would appropriately reflect this fakakta market.

Was thinking that a driver of the 'pop' could have been Apple (AAPL) who reported earnings tonite after the bell. Alas, it looks like AAPL's results did not measure up, and there is selling pressure in after hours trading.

We'll see what tomorrow brings.

Should we happen to get some strength, I plan to shave some more CSCO long and put on some more SH short to hedge my current stance.

position in CSCO, SH

Today's challenge was largely mounted on the back of a late day surge on news that the EU was getting set to ban naked CDSs.

Since last weekend, I've been visualizing a 'pop-and-drop' scenario that would mirror the 'drop-and-pop' event from a couple of weeks ago. A sort of poetic symmetry that would appropriately reflect this fakakta market.

Was thinking that a driver of the 'pop' could have been Apple (AAPL) who reported earnings tonite after the bell. Alas, it looks like AAPL's results did not measure up, and there is selling pressure in after hours trading.

We'll see what tomorrow brings.

Should we happen to get some strength, I plan to shave some more CSCO long and put on some more SH short to hedge my current stance.

position in CSCO, SH

The Influence of Dividends

Borrowed the chart below from this article. The graph suggests the dominant influence of dividends on stock performance over time.

Since 1871, dividends account for more than half the nominal gains in the S&P 500 Index. Today many folks shun dividends in search of capital gains. Over time, however, capital gains have accounted for less than 2% of the 8.8% annual return.

Parenthetically, note that there was no inflation prior to the mid 1910's. The Federal Reserve Act was passed in 1913.

Before running out and loading up on dividend paying stocks right here, keep in mind that average dividend yields rest at the low end of historical benchmarks. Current yield on the SPX is about 2%. Historical buying opportunities in stocks have typically corresponded to aggregate yields in the 5-6% range or higher.

While there may be special situations here or there that are paying outsized dividends, I'm trying to remain patient for much higher dividend yields in aggregate before 'buying the list.'

position in SPX

Since 1871, dividends account for more than half the nominal gains in the S&P 500 Index. Today many folks shun dividends in search of capital gains. Over time, however, capital gains have accounted for less than 2% of the 8.8% annual return.

Parenthetically, note that there was no inflation prior to the mid 1910's. The Federal Reserve Act was passed in 1913.

Before running out and loading up on dividend paying stocks right here, keep in mind that average dividend yields rest at the low end of historical benchmarks. Current yield on the SPX is about 2%. Historical buying opportunities in stocks have typically corresponded to aggregate yields in the 5-6% range or higher.

While there may be special situations here or there that are paying outsized dividends, I'm trying to remain patient for much higher dividend yields in aggregate before 'buying the list.'

position in SPX

Friday, October 14, 2011

Minding the Gap

Bought some DBC early last week when prices were falling into the abyss. My thought was that if markets reversed higher, then this might be good for a trade up to about $28.

Why $28? Because once prices broke below that level last month, $28 defines a formidable resistance level. In the context of technical analysis, resistance defines a price level likely to retard further price advances due to the presence of latent supply--such as all those people who bought around $28 early last month and are now trying to get out at a price that lets them come close to break even. Short sellers may also lean on this level and sell come shares short with tight defined risk (i.e., if prices go north of $28, then shorts consider that as an indicator that this was a bad trade, and subsequently stop themselves out).

Moreover, gaps similar to the one that reflected the price breakdown in mid Sept often serve as magnets if/when prices retrace. Indeed, there's a saying among technicians that 'all gaps are meant to be filled.'

To add one more tidbit of rationale to my DBC sale, short term stochastics (e.g., the MACD shown above) were looking pretty toppy, suggesting an 'overbought' condition in the near term. Markets tend to ebb and flow between optimism and pessimism on multiple time frames; presently we may be approaching an excess of optimism in the near term.

As such, when DBC lifted into the gap area today, it was time for me to go.

no positions

Why $28? Because once prices broke below that level last month, $28 defines a formidable resistance level. In the context of technical analysis, resistance defines a price level likely to retard further price advances due to the presence of latent supply--such as all those people who bought around $28 early last month and are now trying to get out at a price that lets them come close to break even. Short sellers may also lean on this level and sell come shares short with tight defined risk (i.e., if prices go north of $28, then shorts consider that as an indicator that this was a bad trade, and subsequently stop themselves out).

Moreover, gaps similar to the one that reflected the price breakdown in mid Sept often serve as magnets if/when prices retrace. Indeed, there's a saying among technicians that 'all gaps are meant to be filled.'

To add one more tidbit of rationale to my DBC sale, short term stochastics (e.g., the MACD shown above) were looking pretty toppy, suggesting an 'overbought' condition in the near term. Markets tend to ebb and flow between optimism and pessimism on multiple time frames; presently we may be approaching an excess of optimism in the near term.

As such, when DBC lifted into the gap area today, it was time for me to go.

no positions

Wednesday, October 12, 2011

Resistance at SPX 1220

The steep rally that we've been experiencing was repelled in an assualt of SPX 1220ish today. This resistance has been a line of serious upside contention over the past 2-3 months (just as 1120 had been on the downside).

Best case for the bulls would be to do work underneath resistance for a few days--both to work off overbought conditions and to chew through latent supply.

I for one have started building a short side hedge again and added to it near 1220. I plan to increase this hedge as well as make some sales in CSCO should the stock continue to trade higher. Would prefer to get more balanced here.

Gun to head has me thinking they go higher from here, but given the macro state of the world, the opposite would not surprise me.

position in CSCO, SPX

Best case for the bulls would be to do work underneath resistance for a few days--both to work off overbought conditions and to chew through latent supply.

I for one have started building a short side hedge again and added to it near 1220. I plan to increase this hedge as well as make some sales in CSCO should the stock continue to trade higher. Would prefer to get more balanced here.

Gun to head has me thinking they go higher from here, but given the macro state of the world, the opposite would not surprise me.

position in CSCO, SPX

Tuesday, October 11, 2011

Technical Crossroads for CSCO

Since last Tuesday's late day reversal, stock markets have been on fire, with the SPX rallying about 120 handles from last week's lows.

Cisco (CSCO) has been showing good relative strength during the rally. It is now facing an importantly level technically as it is challenging the intermediate downtrend line. A break out here suggests a measured move into the $18-19 area.

A bullish factor in CSCO's favor is the reverse head and shoulders pattern that has been tracing out over the past few months. Price is currently trying to puncture the neckline at $17ish which, ironically, defines the downtrend resistance as well.

Next few days should provide some insight on whether CSCO can power over the hump.

position in CSCO, SPX

Cisco (CSCO) has been showing good relative strength during the rally. It is now facing an importantly level technically as it is challenging the intermediate downtrend line. A break out here suggests a measured move into the $18-19 area.

A bullish factor in CSCO's favor is the reverse head and shoulders pattern that has been tracing out over the past few months. Price is currently trying to puncture the neckline at $17ish which, ironically, defines the downtrend resistance as well.

Next few days should provide some insight on whether CSCO can power over the hump.

position in CSCO, SPX

Friday, October 7, 2011

The EU's Circularity Problem

Kyle Bass thinks that the EU is engaged in a game of chicken with Greece right now. Greece is broke and running deficits, and they are certain to default. A nice point here that countries that commit more to bailout facilities jeopardize their own sovereign debt ratings, since they are now on the hook for more liabilities.

Bass concludes that the math simply doesn't work. Even Germany is a debtor nation. No matter how one looks at the magical faclities being erected to contain/bailout EU members, the bottom line is the 'solution' being offered is adding more debt to a sovereign debt problem. More leverage.

KB suspects that many people have yet to think the circular nature of this plan thru.

I think he's right. Right now, markets seem relieved that 'something' is being done. Once the euphoria lifts, however, they will likely see the same old problem staring at them.

What solves a debt crisis? Paying the debt down or restructuring (a.k.a. default). Either way, standard of living will go down.

What brings this 'solution' about faster? Germany decides not to participate. Bass thinks this to be likely, based on his firm's analysis, which includes on-the-ground polling of influential Germans.

no positions

Bass concludes that the math simply doesn't work. Even Germany is a debtor nation. No matter how one looks at the magical faclities being erected to contain/bailout EU members, the bottom line is the 'solution' being offered is adding more debt to a sovereign debt problem. More leverage.

KB suspects that many people have yet to think the circular nature of this plan thru.

I think he's right. Right now, markets seem relieved that 'something' is being done. Once the euphoria lifts, however, they will likely see the same old problem staring at them.

What solves a debt crisis? Paying the debt down or restructuring (a.k.a. default). Either way, standard of living will go down.

What brings this 'solution' about faster? Germany decides not to participate. Bass thinks this to be likely, based on his firm's analysis, which includes on-the-ground polling of influential Germans.

no positions

Tuesday, October 4, 2011

Late Day Reversal

Markets continued to sink on the opening bell this am. An hour or two into the day, I felt a tinge of remorse after unloading my short position yesterday.

Weakness continued until late in the day, when chatter surfaced that the European officials were creating a 'bad bank' entity to dump troubled securities tied to the sovereign debt crisis in the EU. In the final 45 minutes of the trading day, markets went from being down 1.5% to being up 2%. The SPX recaptured the 1120 level and had nearly a 50 handle intra day range.

Naturally, any remorse still pulsing thru my veins suddenly vanished.

Coupled with reclaiming previous support, the long tail pattern on the charts suggests a 'flush' and perhaps a near term low. Add to that my growing sense that sentiment was getting pretty ugly (e.g., I got a call last night from a distraught friend who was down big and wanted to sell all of his stocks), and perhaps we have the makings of a durable rally.

I do know that I'm in no hurry to re-engage on the short side right now. Would rather sit back and observe for a bit.

Did nibble on some DBC this am as commodities have been getting hammered and many are sitting on technincal support.

position in DBC

Weakness continued until late in the day, when chatter surfaced that the European officials were creating a 'bad bank' entity to dump troubled securities tied to the sovereign debt crisis in the EU. In the final 45 minutes of the trading day, markets went from being down 1.5% to being up 2%. The SPX recaptured the 1120 level and had nearly a 50 handle intra day range.

Naturally, any remorse still pulsing thru my veins suddenly vanished.

Coupled with reclaiming previous support, the long tail pattern on the charts suggests a 'flush' and perhaps a near term low. Add to that my growing sense that sentiment was getting pretty ugly (e.g., I got a call last night from a distraught friend who was down big and wanted to sell all of his stocks), and perhaps we have the makings of a durable rally.

I do know that I'm in no hurry to re-engage on the short side right now. Would rather sit back and observe for a bit.

Did nibble on some DBC this am as commodities have been getting hammered and many are sitting on technincal support.

position in DBC

Monday, October 3, 2011

SPX 1120 Support Decisively Broken

The battleground support level that was SPX 1120 finally gave way today in a significant way, with the index spilling lower to about 1100 by day's end. Technically, the 1025-1050 provides the next substantial layer of support.

I unwound my short position into this move. Covered about half into the initial break into the 1115 area and the remainder into the thrust toward 1100.

Why cover it all here? First, for me shortin's hard mon, even when I'm using it as a hedge. Was starting to worry over the position a bit too much and, after this thrust lower, felt prudent to take the position off and look at the situation with fresh eyes tomorrow.

Moreover, some measures of sentiment point toward extreme near term bearishness. It would not take much news to ignite a pretty strong short covering rally.

Should stock melt lower from here, I'll be looking to put on some long side risk for a trade. Should we rally, I'll likely look to re-engage the short side to some degree.

With my hedge off, I'm currently at ~15% risky assets (CSCO, scattered commodities) with the remainder in cash. Yes, I feel a bit 'naked.' But something tells me that this feeling won't last long.

position in CSCO, GLD, SLV, RJA

I unwound my short position into this move. Covered about half into the initial break into the 1115 area and the remainder into the thrust toward 1100.

Why cover it all here? First, for me shortin's hard mon, even when I'm using it as a hedge. Was starting to worry over the position a bit too much and, after this thrust lower, felt prudent to take the position off and look at the situation with fresh eyes tomorrow.

Moreover, some measures of sentiment point toward extreme near term bearishness. It would not take much news to ignite a pretty strong short covering rally.

Should stock melt lower from here, I'll be looking to put on some long side risk for a trade. Should we rally, I'll likely look to re-engage the short side to some degree.

With my hedge off, I'm currently at ~15% risky assets (CSCO, scattered commodities) with the remainder in cash. Yes, I feel a bit 'naked.' But something tells me that this feeling won't last long.

position in CSCO, GLD, SLV, RJA

ECRI Recession Call

Of all the recession forecasting entities out there, the Economic Cycle Research Institute (ECRI) has the best track record by far. Not only that, but ECRI recession calls tend to lead mainstream calls by months.

Last week ECRI told its clients that, based on current levels and trends of its proprietary Weekly Leading Index indicator, the US economy is slipping back into recession.

Last week ECRI told its clients that, based on current levels and trends of its proprietary Weekly Leading Index indicator, the US economy is slipping back into recession.

Sunday, October 2, 2011

Dollar Strength

While few can be more bearish than I me about the US Dollar in the long term, I picked up some UUP calls last summer because of the extreme technical and sentiment picture in the near term.

The dollar began rallying as markets tanked in August as dollar carry traders became risk averse and began unwinding leveraged trades funded w/ borrowed dollars.

As problem continue in Europe, folks have been selling Euros which has added more strength to the dollar.

UUP is currently 'doing work' right aroud the 22.25 resistance level. Should it break thru decisively, the technicals suggest 23.25ish as the next challenge.

Observe that back in late 2008 the dollar really moved when deleveraging kicked in. Another move like that can't be dismissed out of hand. The global macro picture continues to darken. And technical oscillators do not suggest a seriously overbought situation--i.e., they have yet to 'pretzel' on the upper end of the scales.

So, although I think the dollar could very well turn to dust over time, right now traders may view it as the best house in a bad neighborhood.

position in UUP

The dollar began rallying as markets tanked in August as dollar carry traders became risk averse and began unwinding leveraged trades funded w/ borrowed dollars.

As problem continue in Europe, folks have been selling Euros which has added more strength to the dollar.

UUP is currently 'doing work' right aroud the 22.25 resistance level. Should it break thru decisively, the technicals suggest 23.25ish as the next challenge.

Observe that back in late 2008 the dollar really moved when deleveraging kicked in. Another move like that can't be dismissed out of hand. The global macro picture continues to darken. And technical oscillators do not suggest a seriously overbought situation--i.e., they have yet to 'pretzel' on the upper end of the scales.

So, although I think the dollar could very well turn to dust over time, right now traders may view it as the best house in a bad neighborhood.

position in UUP

Saturday, October 1, 2011

Bearish End of Week Action

Late week action, including a -2.5% day for quarter end on Friday for the SPX, left weekly chart with a bearish looking 'inverted hammer' bar. The Fri close was a few handles above the 1120 level that has been challenged multiple times over the past couple of months.

Am having an increasingly difficult time visualizing the 1120 support level holding. Technically, we know that support tends to weaken a bit more each time it is challenged (as another layer of demand is stripped away). Combine this with rich aggregate valuations and an increasingly ugly macro picture and you have the recipe for lower prices.

Chart gazing suggests the 1025-1050 area as the next layer of support below. After that, 950.

I did kick some incremental short side trading exposure added early in the week in the Fri after hrs session (indexes drifted a bit lower after the regular session closed).

How they trade early next week will dictate next move...

position in SPX

Am having an increasingly difficult time visualizing the 1120 support level holding. Technically, we know that support tends to weaken a bit more each time it is challenged (as another layer of demand is stripped away). Combine this with rich aggregate valuations and an increasingly ugly macro picture and you have the recipe for lower prices.

Chart gazing suggests the 1025-1050 area as the next layer of support below. After that, 950.

I did kick some incremental short side trading exposure added early in the week in the Fri after hrs session (indexes drifted a bit lower after the regular session closed).

How they trade early next week will dictate next move...

position in SPX

Wednesday, September 28, 2011

Doctor Copper

Copper is often referred to as 'Dr Copper,' because it is said that the metal has a PhD in economic activity. The metal has so many uses that copper prices are thought to be a valid forecaster of economic strength.

What is Dr Copper telling us right now?

no positions

What is Dr Copper telling us right now?

no positions

Monday, September 26, 2011

New EU Bailout Scheme

The idea de jour in the EU crisis is to have governments borrow money from the ECB to buy assets (such as Greek bonds) from struggling banks. The vehicle for doing this is the EFSF (European Financial Stabilization Facility), which is a special purpose vehicle (SPV) established in 2010 and backed by EU country guarantees. The EFSF provides assistance to eurozone states in financial difficulty. The EFSF would essentially borrow using their country's assets as collateral.

The size of the borrowings necessary? Perhaps $1-2 trillion...

If this sounds like a version of TARP, then you'd be somewhat correct since the focus would be buying 'troubled assets.' In the case of TARP, however, government funds bought troubled assets from private sector banks. Under the latest EU plan, government money would be levered up with ECB money (more government money) to buy bonds from the same governments on the hook for the EFSF and ECB money to begin with.

How long before Mr Ponzi enters this discussion?

The only way such a program could be marginally effective is if Germany and France absorb an outsized share of the risk--well beyond what they have currently committed to contribute.

Which brings us back to the conclusion we've been reaching for months (here, here). Should Germany decide not to participate, then it all crumbles, cookie.

For today, anyway, markets were willing to look at the glass half full side of the story, with domestic markets up a couple of percent or so on the prospect of a $trillion EU bail out.

position in SPX

The size of the borrowings necessary? Perhaps $1-2 trillion...

If this sounds like a version of TARP, then you'd be somewhat correct since the focus would be buying 'troubled assets.' In the case of TARP, however, government funds bought troubled assets from private sector banks. Under the latest EU plan, government money would be levered up with ECB money (more government money) to buy bonds from the same governments on the hook for the EFSF and ECB money to begin with.

How long before Mr Ponzi enters this discussion?

The only way such a program could be marginally effective is if Germany and France absorb an outsized share of the risk--well beyond what they have currently committed to contribute.

Which brings us back to the conclusion we've been reaching for months (here, here). Should Germany decide not to participate, then it all crumbles, cookie.

For today, anyway, markets were willing to look at the glass half full side of the story, with domestic markets up a couple of percent or so on the prospect of a $trillion EU bail out.

position in SPX

Sunday, September 25, 2011

Long Bond Yields at All Time Lows

Below is monthly chart of the yield on a ten year Treasury note over the past 20 years. Earlier this month 10 yr yields dropped below 2% for the first time ever.

After the Fed announced Operation Twist this past wk, yields broke lower yet again. They now reside at about 1.8%.

The Fed is trying to buoy economic activity thru borrowing--particularly w.r.t. housing. But anyone with a pulse recognizes that interest rates, which have been at generational lows for months, do not constitute a binding constraint on economic activity here. Economies around the world are already choking on debt and have little appetite for more. The Fed is thus pushing on a string.

Two groups are especially hurt by Fed policy here. Retired people and other savers are having trouble making ends meet as it is becoming impossible to make ends meet by making 1-2% off modest principal. Savings are being gutted by Fed policy. Moreover, low returns on savings are nudging more people into risky assets such as dividend-paying stocks.

Keep in mind that, over time, savings are the driver of higher standard of living as resources set aside are invested in productivity-enhancing technologies.

Pension funds are also significantly impacted by long bond rates. Pensions funds are built on bond portfolios, and these portfolios are returning less and less. Lower bond yields increase pension fund assumptions about future liabilities, thereby creating funding gaps. To close these gaps, pension fund managers can take more risk increasing their allocation towards stocks, or, in the case of corporate pension funds, have the corporate parents write checks out of retained earnings to fund the shortfall. Those checks in turn reduce earnings...

By discouraging saving and encouraging risk taking, current Fed policy serves as a major drag on standard of living.

position in SPX

After the Fed announced Operation Twist this past wk, yields broke lower yet again. They now reside at about 1.8%.

The Fed is trying to buoy economic activity thru borrowing--particularly w.r.t. housing. But anyone with a pulse recognizes that interest rates, which have been at generational lows for months, do not constitute a binding constraint on economic activity here. Economies around the world are already choking on debt and have little appetite for more. The Fed is thus pushing on a string.