Nice piece by John Mauldin on the sketchy nature of last week's EU summit plan w.r.t. Greece. Long on hope, short on substance.

Two particularly salient points:

Guaranteeing 20% of a government bond is pointless. When sovereign debt goes south, it is usually for a whole lot more than 20%. Greece is starting at 50%.

Changing the CDS rules. Part of last week's accord was that Greek bondholders would agree to a 50% writedown. Because this was agreed to by the creditors, the contention is that this was not a formal default, thus it would not flip the 'credit event' switch on credit default swaps.

Those big banks who were short gobs of Greek sovereign CDS's thus got a big bailout.

Those long Greek sovereign CDSs basically learned that the rules governing CDS's could be changed midstream. If these folks were seeking to hedge Greek debt exposure or bet on a Greek default they have to a) find another vehicle, or b) no participate in this market.

As such, should it be at all surprising that we saw sovereign debt of other EU countries weaken over the past few days?

position in SPX

Monday, October 31, 2011

Sunday, October 30, 2011

Ags Look Interesting

Have been adding to my agricultural commodity position (RJA) over the past few days. From a technical standpoint, looks like a multi-month reverse head-and-shoulders to me w/ a gap directly above (gaps tend to be magnets for price).

From a fundamental/macro standpoint, we've waxed about the bullish set-up in commodities before (dollar heading to dust, capacity not keeping up w/ demand, gov't policies that favor famine).

As such, I'm digging this for the long side of my hedge book.

position in RJA

From a fundamental/macro standpoint, we've waxed about the bullish set-up in commodities before (dollar heading to dust, capacity not keeping up w/ demand, gov't policies that favor famine).

As such, I'm digging this for the long side of my hedge book.

position in RJA

Friday, October 28, 2011

Did Germany Capitulate?

Many view yesterday's EU agreement as a capitulation by Germany. Essentially, risk was re-syndicated from the balance sheets of banks lugging euro sovereign debt onto the backs of German taxpayers.

Germany has essentially signalled the loss of its individual sovereignty in for of the EU collective.

Peter Atwater cautions against this conclusion. Yesterday's events bring into ever greater focus Germany's continued willingness and capacity to support the rest of Europe.

Many view yesterday's events as Germany's willingness to write giant blank checks to the rest of the EU. Atwater disagrees, and suggests instead that Germany will likely make future funds contingent on specific and prehaps tortuous preconditions.

If Peter is correct, then markets are nowhere close to figuring this out.

position in SPX

Germany has essentially signalled the loss of its individual sovereignty in for of the EU collective.

Peter Atwater cautions against this conclusion. Yesterday's events bring into ever greater focus Germany's continued willingness and capacity to support the rest of Europe.

Many view yesterday's events as Germany's willingness to write giant blank checks to the rest of the EU. Atwater disagrees, and suggests instead that Germany will likely make future funds contingent on specific and prehaps tortuous preconditions.

If Peter is correct, then markets are nowhere close to figuring this out.

position in SPX

Thursday, October 27, 2011

Making Sales

Sold most of my Cisco (CSCO) position. Did some yesterday and then lion's share this am into the EU bailout euphoria. Will keep a small 'core' position bought at much lower levels. I do think that the stock reflects decent value here but I also think chances of buying it much cheaper in the next few months are good given the macro set-up.

After the sale, my overall risk position is pretty much hedged. My remaining position in CSCO coupled with some commodity exposure (GLD, SLV, RJA) is offset nearly one for one by an index equity short (SH).

If prices continue to rip higher from here, then I might sell of bit of commodity exposure or add a bit to my index short. If prices reverse lower from here, then I might add some more precious metal exposure or shed some of my short position.

Meanwhile I wanna sit back and observe for a while.

position in CSCO, GLD, SLV, RJA, SH

After the sale, my overall risk position is pretty much hedged. My remaining position in CSCO coupled with some commodity exposure (GLD, SLV, RJA) is offset nearly one for one by an index equity short (SH).

If prices continue to rip higher from here, then I might sell of bit of commodity exposure or add a bit to my index short. If prices reverse lower from here, then I might add some more precious metal exposure or shed some of my short position.

Meanwhile I wanna sit back and observe for a while.

position in CSCO, GLD, SLV, RJA, SH

Monday, October 24, 2011

More Resistance Overhead

Markets continue to gear higher. The SPX is now up 17% from the early Oct lows. Can it continue? Sure, markets can do anything they want, cookie.

The technicals suggest some stiff resistance dead ahead in the 1260ish area. Many of the stochastic oscillators are starting to 'pretzel' in overbought zones on a daily basis.

I for one have resumed hedging mode, adding some index shorts (SH) against my equity (CSCO) longs. I have trimmed a bit of CSCO but hope to do much more into any further strength.

Have also been adding some GLD and ultimately would like that to represent the lion's share of my long side exposure here.

Right now I'm 7-8% net long. I hope to be 'delta neutral' in the near future. Long some CSCO and GLD paired against an index short.

position in CSCO, GLD, SH

The technicals suggest some stiff resistance dead ahead in the 1260ish area. Many of the stochastic oscillators are starting to 'pretzel' in overbought zones on a daily basis.

I for one have resumed hedging mode, adding some index shorts (SH) against my equity (CSCO) longs. I have trimmed a bit of CSCO but hope to do much more into any further strength.

Have also been adding some GLD and ultimately would like that to represent the lion's share of my long side exposure here.

Right now I'm 7-8% net long. I hope to be 'delta neutral' in the near future. Long some CSCO and GLD paired against an index short.

position in CSCO, GLD, SH

Tuesday, October 18, 2011

SPX Tests Resistance Level Again

Once again, it was close but no cigar as the SPX once again challenged the 1225 level but could not decisively break through.

Today's challenge was largely mounted on the back of a late day surge on news that the EU was getting set to ban naked CDSs.

Since last weekend, I've been visualizing a 'pop-and-drop' scenario that would mirror the 'drop-and-pop' event from a couple of weeks ago. A sort of poetic symmetry that would appropriately reflect this fakakta market.

Was thinking that a driver of the 'pop' could have been Apple (AAPL) who reported earnings tonite after the bell. Alas, it looks like AAPL's results did not measure up, and there is selling pressure in after hours trading.

We'll see what tomorrow brings.

Should we happen to get some strength, I plan to shave some more CSCO long and put on some more SH short to hedge my current stance.

position in CSCO, SH

Today's challenge was largely mounted on the back of a late day surge on news that the EU was getting set to ban naked CDSs.

Since last weekend, I've been visualizing a 'pop-and-drop' scenario that would mirror the 'drop-and-pop' event from a couple of weeks ago. A sort of poetic symmetry that would appropriately reflect this fakakta market.

Was thinking that a driver of the 'pop' could have been Apple (AAPL) who reported earnings tonite after the bell. Alas, it looks like AAPL's results did not measure up, and there is selling pressure in after hours trading.

We'll see what tomorrow brings.

Should we happen to get some strength, I plan to shave some more CSCO long and put on some more SH short to hedge my current stance.

position in CSCO, SH

The Influence of Dividends

Borrowed the chart below from this article. The graph suggests the dominant influence of dividends on stock performance over time.

Since 1871, dividends account for more than half the nominal gains in the S&P 500 Index. Today many folks shun dividends in search of capital gains. Over time, however, capital gains have accounted for less than 2% of the 8.8% annual return.

Parenthetically, note that there was no inflation prior to the mid 1910's. The Federal Reserve Act was passed in 1913.

Before running out and loading up on dividend paying stocks right here, keep in mind that average dividend yields rest at the low end of historical benchmarks. Current yield on the SPX is about 2%. Historical buying opportunities in stocks have typically corresponded to aggregate yields in the 5-6% range or higher.

While there may be special situations here or there that are paying outsized dividends, I'm trying to remain patient for much higher dividend yields in aggregate before 'buying the list.'

position in SPX

Since 1871, dividends account for more than half the nominal gains in the S&P 500 Index. Today many folks shun dividends in search of capital gains. Over time, however, capital gains have accounted for less than 2% of the 8.8% annual return.

Parenthetically, note that there was no inflation prior to the mid 1910's. The Federal Reserve Act was passed in 1913.

Before running out and loading up on dividend paying stocks right here, keep in mind that average dividend yields rest at the low end of historical benchmarks. Current yield on the SPX is about 2%. Historical buying opportunities in stocks have typically corresponded to aggregate yields in the 5-6% range or higher.

While there may be special situations here or there that are paying outsized dividends, I'm trying to remain patient for much higher dividend yields in aggregate before 'buying the list.'

position in SPX

Friday, October 14, 2011

Minding the Gap

Bought some DBC early last week when prices were falling into the abyss. My thought was that if markets reversed higher, then this might be good for a trade up to about $28.

Why $28? Because once prices broke below that level last month, $28 defines a formidable resistance level. In the context of technical analysis, resistance defines a price level likely to retard further price advances due to the presence of latent supply--such as all those people who bought around $28 early last month and are now trying to get out at a price that lets them come close to break even. Short sellers may also lean on this level and sell come shares short with tight defined risk (i.e., if prices go north of $28, then shorts consider that as an indicator that this was a bad trade, and subsequently stop themselves out).

Moreover, gaps similar to the one that reflected the price breakdown in mid Sept often serve as magnets if/when prices retrace. Indeed, there's a saying among technicians that 'all gaps are meant to be filled.'

To add one more tidbit of rationale to my DBC sale, short term stochastics (e.g., the MACD shown above) were looking pretty toppy, suggesting an 'overbought' condition in the near term. Markets tend to ebb and flow between optimism and pessimism on multiple time frames; presently we may be approaching an excess of optimism in the near term.

As such, when DBC lifted into the gap area today, it was time for me to go.

no positions

Why $28? Because once prices broke below that level last month, $28 defines a formidable resistance level. In the context of technical analysis, resistance defines a price level likely to retard further price advances due to the presence of latent supply--such as all those people who bought around $28 early last month and are now trying to get out at a price that lets them come close to break even. Short sellers may also lean on this level and sell come shares short with tight defined risk (i.e., if prices go north of $28, then shorts consider that as an indicator that this was a bad trade, and subsequently stop themselves out).

Moreover, gaps similar to the one that reflected the price breakdown in mid Sept often serve as magnets if/when prices retrace. Indeed, there's a saying among technicians that 'all gaps are meant to be filled.'

To add one more tidbit of rationale to my DBC sale, short term stochastics (e.g., the MACD shown above) were looking pretty toppy, suggesting an 'overbought' condition in the near term. Markets tend to ebb and flow between optimism and pessimism on multiple time frames; presently we may be approaching an excess of optimism in the near term.

As such, when DBC lifted into the gap area today, it was time for me to go.

no positions

Wednesday, October 12, 2011

Resistance at SPX 1220

The steep rally that we've been experiencing was repelled in an assualt of SPX 1220ish today. This resistance has been a line of serious upside contention over the past 2-3 months (just as 1120 had been on the downside).

Best case for the bulls would be to do work underneath resistance for a few days--both to work off overbought conditions and to chew through latent supply.

I for one have started building a short side hedge again and added to it near 1220. I plan to increase this hedge as well as make some sales in CSCO should the stock continue to trade higher. Would prefer to get more balanced here.

Gun to head has me thinking they go higher from here, but given the macro state of the world, the opposite would not surprise me.

position in CSCO, SPX

Best case for the bulls would be to do work underneath resistance for a few days--both to work off overbought conditions and to chew through latent supply.

I for one have started building a short side hedge again and added to it near 1220. I plan to increase this hedge as well as make some sales in CSCO should the stock continue to trade higher. Would prefer to get more balanced here.

Gun to head has me thinking they go higher from here, but given the macro state of the world, the opposite would not surprise me.

position in CSCO, SPX

Tuesday, October 11, 2011

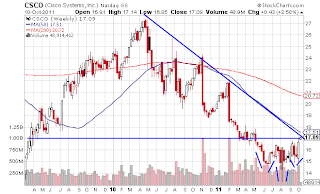

Technical Crossroads for CSCO

Since last Tuesday's late day reversal, stock markets have been on fire, with the SPX rallying about 120 handles from last week's lows.

Cisco (CSCO) has been showing good relative strength during the rally. It is now facing an importantly level technically as it is challenging the intermediate downtrend line. A break out here suggests a measured move into the $18-19 area.

A bullish factor in CSCO's favor is the reverse head and shoulders pattern that has been tracing out over the past few months. Price is currently trying to puncture the neckline at $17ish which, ironically, defines the downtrend resistance as well.

Next few days should provide some insight on whether CSCO can power over the hump.

position in CSCO, SPX

Cisco (CSCO) has been showing good relative strength during the rally. It is now facing an importantly level technically as it is challenging the intermediate downtrend line. A break out here suggests a measured move into the $18-19 area.

A bullish factor in CSCO's favor is the reverse head and shoulders pattern that has been tracing out over the past few months. Price is currently trying to puncture the neckline at $17ish which, ironically, defines the downtrend resistance as well.

Next few days should provide some insight on whether CSCO can power over the hump.

position in CSCO, SPX

Friday, October 7, 2011

The EU's Circularity Problem

Kyle Bass thinks that the EU is engaged in a game of chicken with Greece right now. Greece is broke and running deficits, and they are certain to default. A nice point here that countries that commit more to bailout facilities jeopardize their own sovereign debt ratings, since they are now on the hook for more liabilities.

Bass concludes that the math simply doesn't work. Even Germany is a debtor nation. No matter how one looks at the magical faclities being erected to contain/bailout EU members, the bottom line is the 'solution' being offered is adding more debt to a sovereign debt problem. More leverage.

KB suspects that many people have yet to think the circular nature of this plan thru.

I think he's right. Right now, markets seem relieved that 'something' is being done. Once the euphoria lifts, however, they will likely see the same old problem staring at them.

What solves a debt crisis? Paying the debt down or restructuring (a.k.a. default). Either way, standard of living will go down.

What brings this 'solution' about faster? Germany decides not to participate. Bass thinks this to be likely, based on his firm's analysis, which includes on-the-ground polling of influential Germans.

no positions

Bass concludes that the math simply doesn't work. Even Germany is a debtor nation. No matter how one looks at the magical faclities being erected to contain/bailout EU members, the bottom line is the 'solution' being offered is adding more debt to a sovereign debt problem. More leverage.

KB suspects that many people have yet to think the circular nature of this plan thru.

I think he's right. Right now, markets seem relieved that 'something' is being done. Once the euphoria lifts, however, they will likely see the same old problem staring at them.

What solves a debt crisis? Paying the debt down or restructuring (a.k.a. default). Either way, standard of living will go down.

What brings this 'solution' about faster? Germany decides not to participate. Bass thinks this to be likely, based on his firm's analysis, which includes on-the-ground polling of influential Germans.

no positions

Tuesday, October 4, 2011

Late Day Reversal

Markets continued to sink on the opening bell this am. An hour or two into the day, I felt a tinge of remorse after unloading my short position yesterday.

Weakness continued until late in the day, when chatter surfaced that the European officials were creating a 'bad bank' entity to dump troubled securities tied to the sovereign debt crisis in the EU. In the final 45 minutes of the trading day, markets went from being down 1.5% to being up 2%. The SPX recaptured the 1120 level and had nearly a 50 handle intra day range.

Naturally, any remorse still pulsing thru my veins suddenly vanished.

Coupled with reclaiming previous support, the long tail pattern on the charts suggests a 'flush' and perhaps a near term low. Add to that my growing sense that sentiment was getting pretty ugly (e.g., I got a call last night from a distraught friend who was down big and wanted to sell all of his stocks), and perhaps we have the makings of a durable rally.

I do know that I'm in no hurry to re-engage on the short side right now. Would rather sit back and observe for a bit.

Did nibble on some DBC this am as commodities have been getting hammered and many are sitting on technincal support.

position in DBC

Weakness continued until late in the day, when chatter surfaced that the European officials were creating a 'bad bank' entity to dump troubled securities tied to the sovereign debt crisis in the EU. In the final 45 minutes of the trading day, markets went from being down 1.5% to being up 2%. The SPX recaptured the 1120 level and had nearly a 50 handle intra day range.

Naturally, any remorse still pulsing thru my veins suddenly vanished.

Coupled with reclaiming previous support, the long tail pattern on the charts suggests a 'flush' and perhaps a near term low. Add to that my growing sense that sentiment was getting pretty ugly (e.g., I got a call last night from a distraught friend who was down big and wanted to sell all of his stocks), and perhaps we have the makings of a durable rally.

I do know that I'm in no hurry to re-engage on the short side right now. Would rather sit back and observe for a bit.

Did nibble on some DBC this am as commodities have been getting hammered and many are sitting on technincal support.

position in DBC

Monday, October 3, 2011

SPX 1120 Support Decisively Broken

The battleground support level that was SPX 1120 finally gave way today in a significant way, with the index spilling lower to about 1100 by day's end. Technically, the 1025-1050 provides the next substantial layer of support.

I unwound my short position into this move. Covered about half into the initial break into the 1115 area and the remainder into the thrust toward 1100.

Why cover it all here? First, for me shortin's hard mon, even when I'm using it as a hedge. Was starting to worry over the position a bit too much and, after this thrust lower, felt prudent to take the position off and look at the situation with fresh eyes tomorrow.

Moreover, some measures of sentiment point toward extreme near term bearishness. It would not take much news to ignite a pretty strong short covering rally.

Should stock melt lower from here, I'll be looking to put on some long side risk for a trade. Should we rally, I'll likely look to re-engage the short side to some degree.

With my hedge off, I'm currently at ~15% risky assets (CSCO, scattered commodities) with the remainder in cash. Yes, I feel a bit 'naked.' But something tells me that this feeling won't last long.

position in CSCO, GLD, SLV, RJA

I unwound my short position into this move. Covered about half into the initial break into the 1115 area and the remainder into the thrust toward 1100.

Why cover it all here? First, for me shortin's hard mon, even when I'm using it as a hedge. Was starting to worry over the position a bit too much and, after this thrust lower, felt prudent to take the position off and look at the situation with fresh eyes tomorrow.

Moreover, some measures of sentiment point toward extreme near term bearishness. It would not take much news to ignite a pretty strong short covering rally.

Should stock melt lower from here, I'll be looking to put on some long side risk for a trade. Should we rally, I'll likely look to re-engage the short side to some degree.

With my hedge off, I'm currently at ~15% risky assets (CSCO, scattered commodities) with the remainder in cash. Yes, I feel a bit 'naked.' But something tells me that this feeling won't last long.

position in CSCO, GLD, SLV, RJA

ECRI Recession Call

Of all the recession forecasting entities out there, the Economic Cycle Research Institute (ECRI) has the best track record by far. Not only that, but ECRI recession calls tend to lead mainstream calls by months.

Last week ECRI told its clients that, based on current levels and trends of its proprietary Weekly Leading Index indicator, the US economy is slipping back into recession.

Last week ECRI told its clients that, based on current levels and trends of its proprietary Weekly Leading Index indicator, the US economy is slipping back into recession.

Sunday, October 2, 2011

Dollar Strength

While few can be more bearish than I me about the US Dollar in the long term, I picked up some UUP calls last summer because of the extreme technical and sentiment picture in the near term.

The dollar began rallying as markets tanked in August as dollar carry traders became risk averse and began unwinding leveraged trades funded w/ borrowed dollars.

As problem continue in Europe, folks have been selling Euros which has added more strength to the dollar.

UUP is currently 'doing work' right aroud the 22.25 resistance level. Should it break thru decisively, the technicals suggest 23.25ish as the next challenge.

Observe that back in late 2008 the dollar really moved when deleveraging kicked in. Another move like that can't be dismissed out of hand. The global macro picture continues to darken. And technical oscillators do not suggest a seriously overbought situation--i.e., they have yet to 'pretzel' on the upper end of the scales.

So, although I think the dollar could very well turn to dust over time, right now traders may view it as the best house in a bad neighborhood.

position in UUP

The dollar began rallying as markets tanked in August as dollar carry traders became risk averse and began unwinding leveraged trades funded w/ borrowed dollars.

As problem continue in Europe, folks have been selling Euros which has added more strength to the dollar.

UUP is currently 'doing work' right aroud the 22.25 resistance level. Should it break thru decisively, the technicals suggest 23.25ish as the next challenge.

Observe that back in late 2008 the dollar really moved when deleveraging kicked in. Another move like that can't be dismissed out of hand. The global macro picture continues to darken. And technical oscillators do not suggest a seriously overbought situation--i.e., they have yet to 'pretzel' on the upper end of the scales.

So, although I think the dollar could very well turn to dust over time, right now traders may view it as the best house in a bad neighborhood.

position in UUP

Saturday, October 1, 2011

Bearish End of Week Action

Late week action, including a -2.5% day for quarter end on Friday for the SPX, left weekly chart with a bearish looking 'inverted hammer' bar. The Fri close was a few handles above the 1120 level that has been challenged multiple times over the past couple of months.

Am having an increasingly difficult time visualizing the 1120 support level holding. Technically, we know that support tends to weaken a bit more each time it is challenged (as another layer of demand is stripped away). Combine this with rich aggregate valuations and an increasingly ugly macro picture and you have the recipe for lower prices.

Chart gazing suggests the 1025-1050 area as the next layer of support below. After that, 950.

I did kick some incremental short side trading exposure added early in the week in the Fri after hrs session (indexes drifted a bit lower after the regular session closed).

How they trade early next week will dictate next move...

position in SPX

Am having an increasingly difficult time visualizing the 1120 support level holding. Technically, we know that support tends to weaken a bit more each time it is challenged (as another layer of demand is stripped away). Combine this with rich aggregate valuations and an increasingly ugly macro picture and you have the recipe for lower prices.

Chart gazing suggests the 1025-1050 area as the next layer of support below. After that, 950.

I did kick some incremental short side trading exposure added early in the week in the Fri after hrs session (indexes drifted a bit lower after the regular session closed).

How they trade early next week will dictate next move...

position in SPX

Subscribe to:

Posts (Atom)